kern county property tax rate 2021

Comprehensive frequently updated all in one place. Tax Rates - Kern County Auditor-Controller-County Clerk.

Solar Power Tax Incentive Comes Under Scrutiny From Kern Supervisors As State Begins Transition Away From Oil News Bakersfield Com

Application for Tax Penalty Relief.

. Visit Treasurer-Tax Collectors site. Payment of Property Taxes is handled by the Treasurer-Tax Collectors office. Auditor - Controller - County Clerk.

Just Enter Name and State To Get Started. The Kern County California sales tax is 725 the same as the California state sales tax. Visit Our Website Today Get Records Fast.

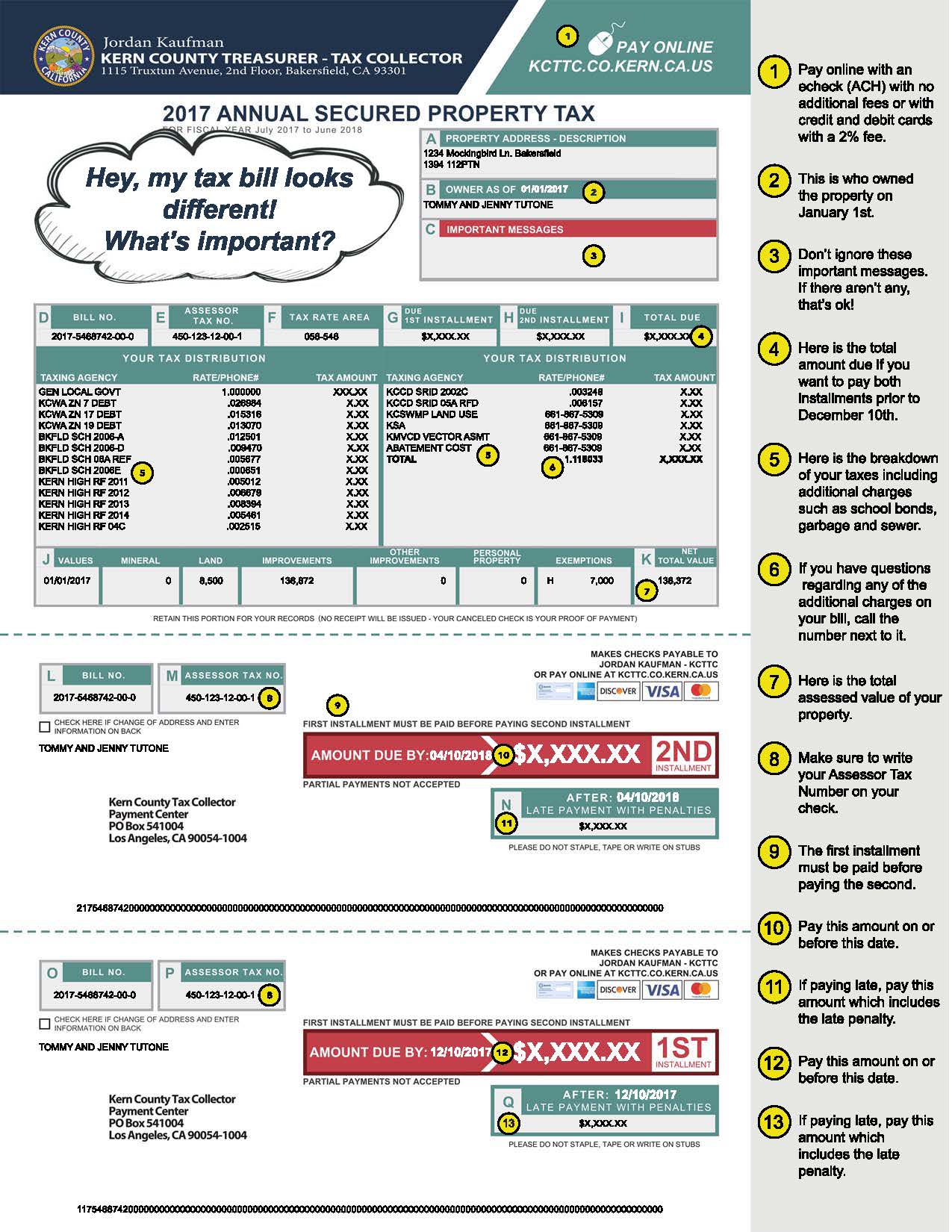

The Treasurer-Tax Collector collects the taxes for the County all public schools incorporated cities and most other governmental agencies within the County. The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. 1115 Truxtun Avenue Bakersfield CA 93301-4639.

Find property records tax records assets values and more. The Treasurer-Tax Collector collects all property taxes. We Provide Homeowner Data Including Property Tax Liens Deeds More.

10 according to a press release from Jordan Kaufman the countys treasurer and tax collector. More than 70 of all taxes collected is allocated to 120 governing boards of schools cities and special districts. Kern County CA Home Menu.

800 AM - 500 PM Mon-Fri 661-868-3599. Establecer un Plan de Pagos. Ad Uncover Available Property Tax Data By Searching Any Address.

Q32021 Q42021 Q12022 Q22022. 2020-2021 Annual Property Tax Rate Book. Kern County CA Home Menu.

Election to Establish an Installment Plan. Request For Escape Assessment Installment Plan. 1115 Truxtun Avenue Bakersfield CA 93301-4639.

2019-2020 Annual Property Tax. Kern County collects on average 08 of a propertys assessed fair. That equates to about an 119 million increase in property tax revenue to the county which had been estimated at around 280 million for fiscal year 2021-22 allowing officials to address a.

You have the right. Kern County property data. Ad View public property records including property assessment mortgage documents and more.

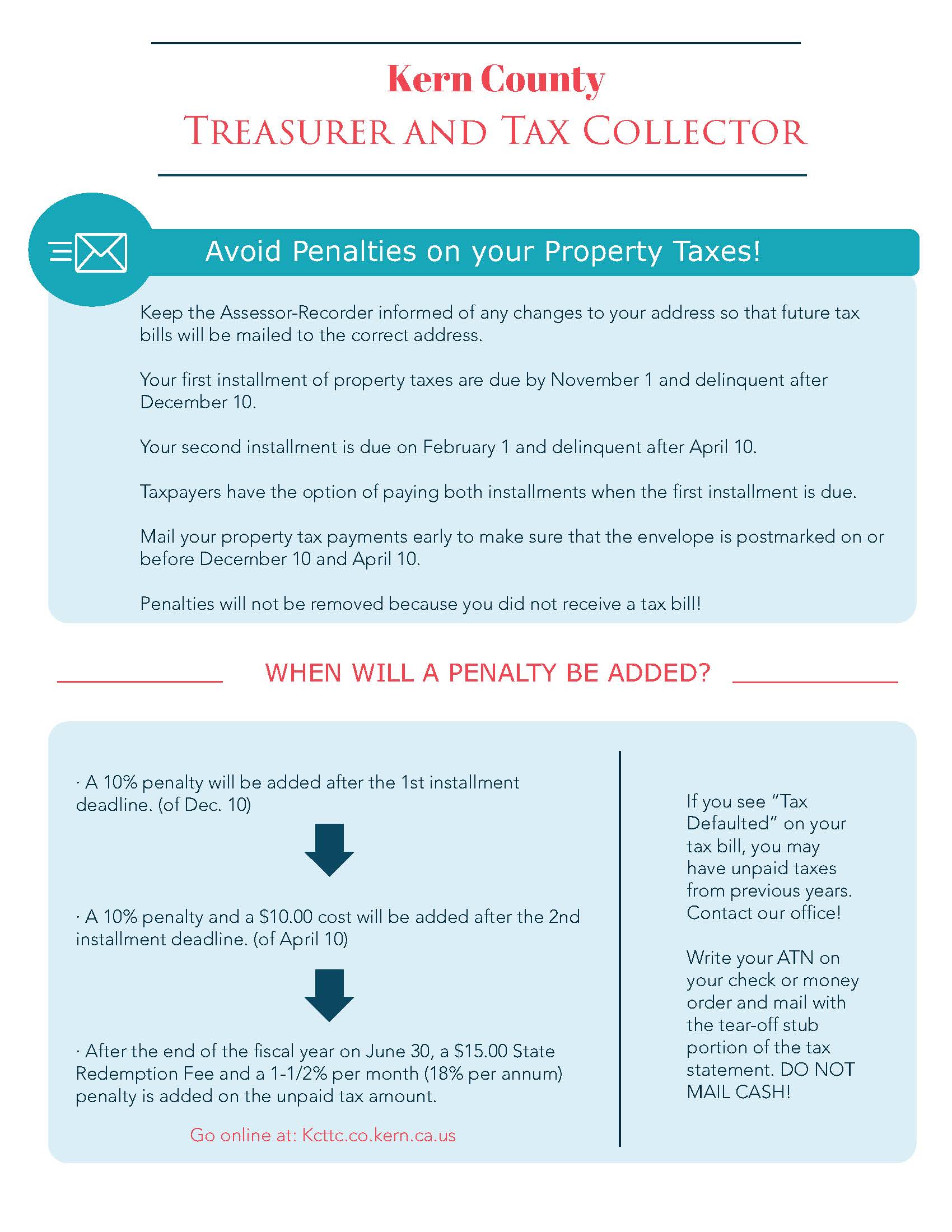

Treasurer-Tax Collector mails delinquent notices for any unpaid regular current taxes. While many other states allow counties and other localities to collect a local option sales tax. 2021 Proposition 19 allows persons over 55.

Property Taxes - Pay by Wire. Property Taxes - Pay Online. Ad Find All The Records You Need In One Place.

Dec 8 2021. Commercial sales stats in Kern County. A 10 penalty plus 1000 cost is added as of 500 pm.

Kern County real property taxes are due by 5 pm. Finding Records For Any Address Is Easy. Auditor - Controller - County Clerk.

Kern County CA Home Menu.

Orange County Ca Property Tax Search And Records Propertyshark

Dallas County Lowers Property Tax Rate Approves 1 6 Billion Budget

Kern Business Journal Winter 2021 By The Bakersfield Californian Specialty Publications Issuu

A New Group Wants To Slash Baltimore S Property Taxes In The Name Of Equity City Hall Calls It Absurd Baltimore Sun

Kern County California Ballot Measures Ballotpedia

Adopted Budget Fy California County Financial Documents Digital Resources For Law And Public Policy

Kern County Treasurer And Tax Collector

Kern County Assessor Recorder S Office Bakersfield Ca Facebook

County Tax Bills Mailed To Property Owners News Bakersfield Com

About The Grand Jury Kern County Ca

Medi Cal Kern County Ca Department Of Human Services

North Central Illinois Economic Development Corporation Property Taxes

Kern County Treasurer And Tax Collector

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Kern County Treasurer And Tax Collector

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Kern County Treasurer And Tax Collector