child tax credit portal update dependents

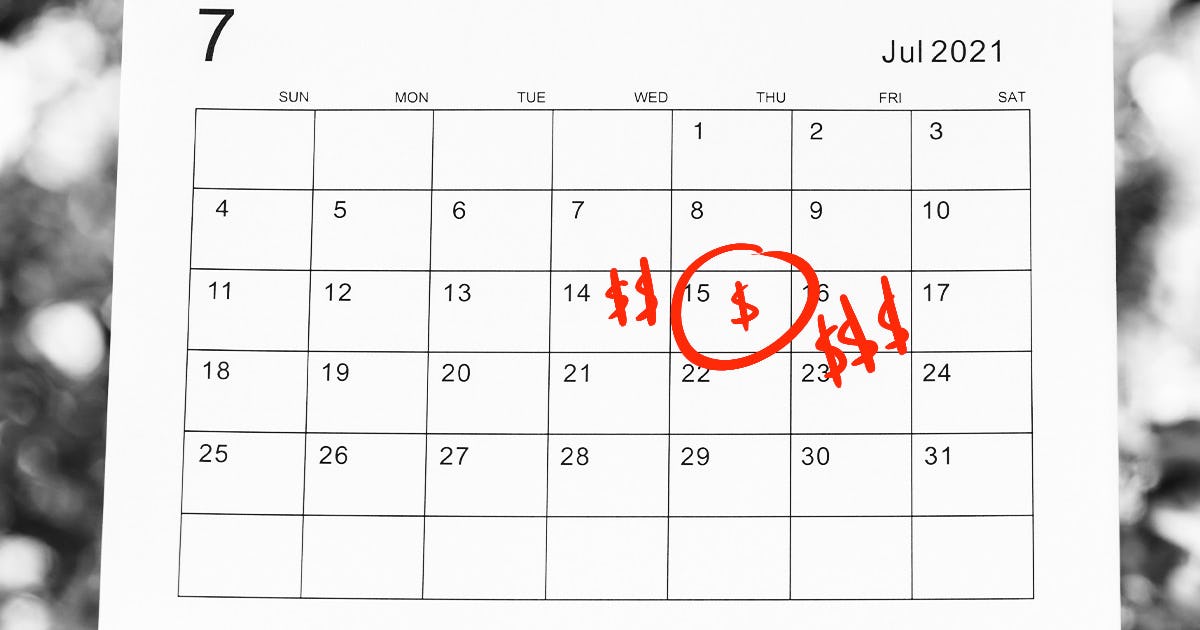

Families should enter changes by November 29 so the changes are reflected in the December payment. Parents can now use the Child Tax Credit Update Portal to check on their payments Credit.

Irs Issues Confusing Advice On Reconciling The Child Tax Credit

File a federal return to claim your child tax credit.

. A nonfiler portal lets you provide the IRS with basic information about yourself and your dependents if you normally. The IRS also launched this week a new Spanish-language version of the Child Tax Credit Update Portal. The Child Tax Credit Update Portal is no longer available but you can see your advance payments total in your online account.

You can use it now to view your payment history. Updates that have been made by August 2 nd 2021 will apply to the August 13 th payment as well as any. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment.

While it has limited features at the minute there are plans to roll out more functions later this month including updating the ages of your dependents your marital status and your income. The tool also allows families to unenroll from the advance payments if they dont want to receive them. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021.

Changes must be made before 1159 pm ET on Nov. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. Be under age 18 at the end of the year.

The IRS will pay 3600 per child to parents of young children up to age five. Single or married and filing separately. Half of the money will come as six monthly payments and.

Be your son daughter stepchild eligible foster child brother sister. The application period will close on July 31 2022 and payments will be issued in August. Use the IRSs Child Tax Credit Update Portal to.

The IRS have said that the tax agency can be notified about any income changes before 2100 PT midnight ET on November 29 which will apply to December 15 payments. COVID Tax Tip 2021-167 November 10 2021. If you are already receiving the maximum amount a decrease in your 2021 income.

If something happens that you are unable to get the payments you can still get the full child tax credit for that child when you file in 2021. Visit ChildTaxCreditgov for details. The IRS recently launched a new feature in its Child Tax Credit Update Portal allowing families receiving monthly advance child tax credit payments to update their income.

Heres how they help parents with eligible dependents. The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child tax credit. Generally you can expect to receive up to 300 per qualifying child under age 6 and 250 per child ages 6 to 17.

Simple or complex always free. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

To reduce the chances of an overpayment you will be able to update the IRS later this summer about changes to your dependents marital status and income through the child tax credit portal. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving. At some point the portal will be updated to allow you to update how many dependants you have.

The full monthly child tax credit benefit is eligible for incomes up to 75000 for individuals 112500 for heads of household and 150000 for married couples. Only families already. Your advance Child Tax Credit payments were based on the children you claimed for the Child Tax Credit on your 2020 tax return or 2019 tax return if your 2020 tax return had not been processed as of the payment determination date for any of your monthly advance Child Tax Credit payments.

Taxpayers can access the Child Tax Credit Update Portal from IRSgov. 932 ET Jul 6 2021. Updating the portal or any changes next year could also result in an additional payment next year if you were underpaid.

To apply applicants should visit portalctgovDRS and click the icon that says 2022 CT Child Tax Rebate. To be a qualifying child for the 2021 tax year your dependent generally must. The Update Portal is available only on IRSgov.

THE IRS has launched child tax credit online portals that will help parents to get the extra stimulus money when the monthly 300 payments begin on July 15. O Check if youre enrolled to receive advance payments o Unenroll from advance payments of the Child Tax Credit o Update or provide bank account information for direct deposit o View the status of your payments o Update or provide a mailing address October 2021. 29 at the portal IRSgovchildtaxcredit2021.

It begins to phase out after that. The Biden administration has extended the Child Tax Credit for 2021 meaning that parents can receive a credit up to 3000 for every child aged between six and 17.

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

Child Tax Credit What Is Irs Letter 6419 Experian

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Stimulus Check Update These Families Will Get 3 600 In 2022 Katv

Payments From The Expanded Child Tax Credit Are Being Sent Out Npr

Families Now Receiving September Child Tax Credit Payments The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

Should I Do My Own Taxes Or Hire An Accountant Use A Chart To Decide

Child Tax Credit Deadline Missed Here S What Parents Need To Know

No Lines No Waiting You Don T Have To Wait For The Irs Refund At The End Of February Get An Advance Up To 300 Online Taxes Filing Taxes Accounting Services

You Could Start Getting A Check For 250 300 Per Child In July Wwltv Com

Child Tax Credit Payment Delays Frustrating Families In Need The Washington Post

Families Now Receiving September Child Tax Credit Payments The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

Indiana Families To Get Child Tax Credit Payments Starting July 15

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

Irs Says Portal Now Open To Update Banking Info For Child Tax Credit Payments